Non-professional purchase for companies

We have added a new option to the order which allows to specify the order for companies as a non-professional purchase. This change adapts the store to the legal changes coming into force on January 1, 2021.

Non-professional purchase - expert comment

“The amendment to the Consumer Rights Act and the Civil Code, which will come into force on January 1, 2021, mainly changes the fact that natural persons conducting business activities in certain cases will gain new privileges and additional consumer protection. This means that they will be treated as consumers, so they will be covered by the protection provided for consumers even though they are entrepreneurs. This is a completely new situation - currently, entrepreneurs who receive an invoice for purchases made do not have any consumer rights. After the change of regulations, i.e. from January 1, 2021, a person conducting business activity will be covered by the protection provided for consumers in the scope of: prohibited clauses, warranty for defects, right to withdraw from a distance contract. Such entrepreneurs do not become consumers as such, but only some consumer rights are granted to them.”

www.adwokat-jaskula.pl

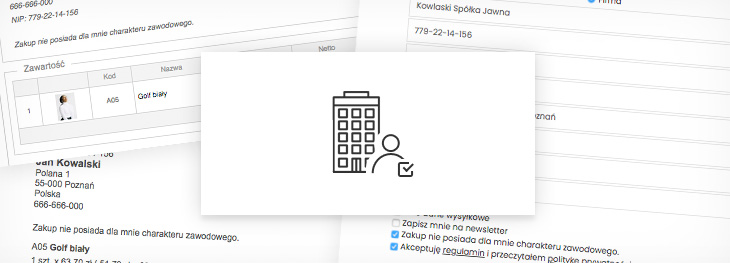

How to activate non-professional purchase for companies?

- First of all, you need to update the store to the latest version.

- In the store panel, select Menu->Orders->Configuration

- Check "Activate non-professional purchase for companies".

After activation, an additional field will appear in the order form for companies. After placing the order, the appropriate information will be added to the order in e-mails, in the store panel and on the user's account.

Store regulations

The appropriate changes should also be added to the store regulations, including defining the consumer and the rights of the entrepreneur for whom the contract is not of a professional nature.

Order a professional regulations for your online store

Related Pages